Don’t Forget Sprouts

By Scott Sanders on Sep 20, 2018 04:28 pm

At last week’s Natural Products Expo East in Baltimore, I was reminded how many emerging brands pin their hopes on making deals with Whole Foods. For many brands, trying to meet with a buyer from Whole Foods is a big part of why they exhibit at Expo East (or the West Coast version, Expo West, which is held in the spring).

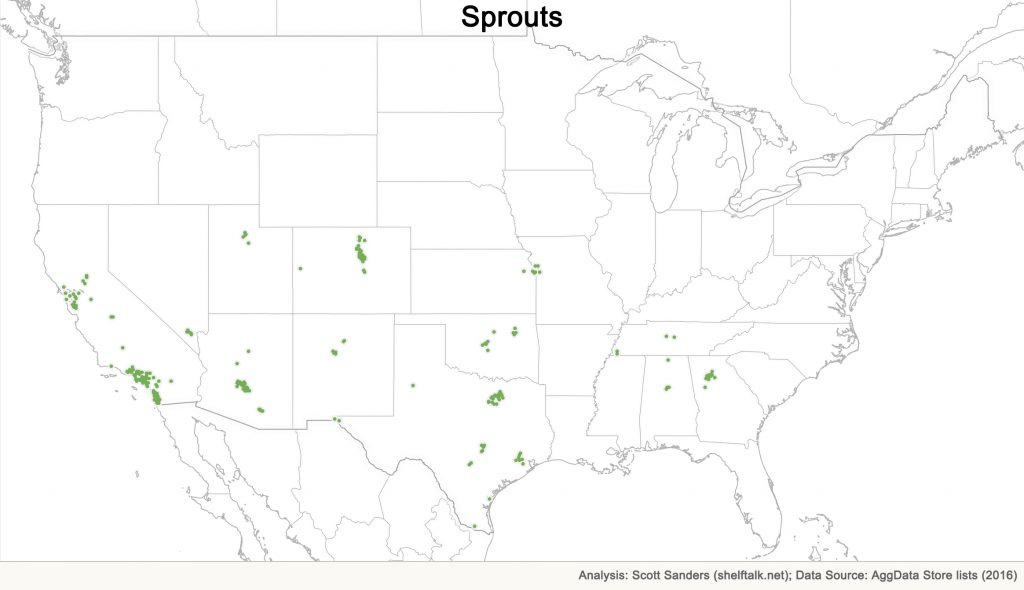

While Whole Foods has over 475 stores, Sprouts Farmers Market has about about 300, or two-thirds as many. The catch is that Sprouts’ stores are predominantly in the southern half of the United States, while Whole Foods is more geographically spread out.

I may not hear much about Sprouts from my colleagues because my network is biased toward the Northeast, where I live and where Sprouts doesn’t have a physical presence. It might be because Sprouts doesn’t get as much media attention as Whole Foods and doesn’t have a pejorative nickname as catchy as “Whole Paycheck.” Or it might be an overlooked opportunity for emerging brands to jump on.

If you’re hitting hurdles while trying to approach Whole Foods, Sprouts could represent an alternate path.

Even bigger is the opportunity to migrate natural and specialty brands into conventional retailers. The U.S. conventional grocery channel has over 35,000 outlets, 45 times more than Whole Foods and Sprouts together. When you add the dollar, convenience store, and drug channels, the store count exceeds 200,000!

More and more conventional retailers are racing to carry broader selections of specialty items since that’s where consumer preference has been heading. I even heard a rumor that Walmart—stereotypically the most conventional of all retailers!—is creating a set focused on ketogenic products.

Don’t keep your distribution strategy too focused on a single retailer. There are many fish in the retail sea.